Anyone in the small business lending industry knows Live Oak Bank. Launched in 2008, it became the 7th #1 SBA lender in the country just nine years later, a position it still maintains today by a wide margin.

This achievement alone is worth mentioning. But for the Wilmington, North Carolina-based bank, which has one branch and $8.6 billion in total assets, it’s just a bid to become “America’s small business bank,” its purported tagline.

You cannot become a primary banking technology for small businesses by lending alone. For most of Live Oak’s 6,000 customers, the relationship is based on credit. This is a highly personal relationship, however, uncommon in small business loans. Live Oak owns three of the company’s airplanes, which it uses to fly about 60 bankers to meet with clients around the country for sales, evaluation, and assurance. Mahan notes that airplanes are much cheaper than branches.

But over the years, the bank has been trying to figure out the deposit side of the equation. With a single branch, most deposits are made through online channels. Despite the high cost of funds from the deal, the bank is doing very well. In the first quarter of 2022, the company’s net interest margin was 4.02%, ROA was 1.5% and ROE was 18.9%. In fact, the quarter was the best ever for the company.

Beware Of Future Winners:

Live Oak Bank has been investing in fintech for nearly a decade, if you count nCino, the banking software company it founded and launched.

“We pay market rates on deposits, like Ally Bank or Marcus,” says the CEO. “But our internal cost of capturing deposits is about seven basis points.” Even if you add seven basis points to the 1% money market rate paid by the bank, he says, you’re still ahead of most of the industry.

But Mahan wants the model to be even better, and he believes it will be, “when we become the refrigerator of the non-interest deposit business,” as he tells The Financial Brand.

How Live Oak Bank plans to accomplish this is explained below. Key to their plans is an innovative core banking platform. One is that it helped finance and development.

Niche Banking And Beyond

For those unfamiliar with Live Oak Bank, it is in many ways the original niche bank. With a single market vertical, veterinary practices, in 2008, the company now has 35 verticals. (Others include funeral homes, self-storage, investment advisors, bioenergy, senior housing, hotels, and poultry businesses.)

The SBA 7a program allows banks to lend to over 1,100 different industries. Mahon believes Live Oak will serve as many as 100 to 150 verticals. He hopes to continue increasing them at a rate of two to four per year.

However, the Bank’s most recent focus is on a two-pronged “common strategy.” One part is recruiting experienced SBA lenders and setting them up in different cities around the country. Right now, Live Oak has about 30 lenders in 28 cities, according to Mahan. He hopes to establish these lenders in 100 U.S. cities “in a relatively short period of time.”

Another part of the strategy is to provide traditional loans to small businesses, which the bank initially avoided. With a mix of more verticals, more geographically oriented SBA lenders, and more traditional business loans, Mahan believes Live Oak can continue to grow at 15% a year, making it a very select company. can be kept

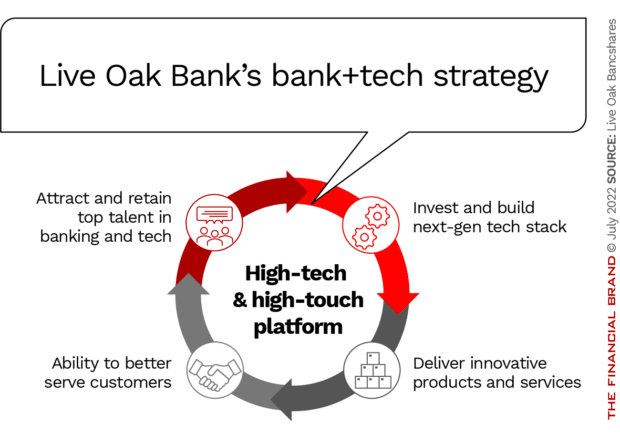

The bank’s highly successful formula is enabled by another key factor: its long-term focus on efficient and innovative technology.

Banking + Fintech Investment Strategies

Live Oak Bancshares is as much a technology company as it is a bank. Three years after the bank opened its doors, it created a wholly owned subsidiary to sell loan origination systems developed by the bank’s engineers. The subsidiary was called nCino.

In building nCino, says Mahan, “we learned a lot about building cloud-native API-first software.” nCino grew so fast that the bank turned the company over to shareholders in 2014.

The bank invests directly in promising fintech through Live Oak Ventures and also through the holding company’s subsidiary Canopy Venture Capital Fund. The bank uses software from many companies in which it invests.

At the heart of the diagram above is FinXact, an innovative real-time core banking system built on the Amazon Web Services (AWS) cloud service. Live Oak was instrumental in the creation and financing of intact.

Mahan is well versed in both technology and the needs of startups. Although he began his banking career as a commercial lender at the former Wachovia Bank, Mahan helped launch one of the first Internet banks (Security First Network Bank) in 1993. He founded the banking technology company S1 Corp. Also founded and ran it for 12 years. . As director of Sal Live Oak Bank, Mahan helped convince his friend and banking technology icon Frank Sanchez in 2016 to build a next-generation core banking system using AWS. New ventures by Live Oak Ventures invested in Rs., which was called FinXact. In April 2022, Live Oak sold its interest in FinXact to Fiserv for $125 million in pre-tax cash.

That leverage allows for several things, according to Live Oak CFO William “BJ” Loesch III, speaking during the bank’s first-quarter earnings call. Among them, he said, it will fund additional loan growth, allow the bank to accelerate various technology initiatives, including hiring more tech talent and capitalize on other fintech investments. Enabling redeployment.

But it is the bank’s own use of FinXact technology that is most important. Both Mahan and Loesch believe that this innovative infrastructure will soon lead to a watershed moment for the bank.

Integrated Banking: Low-Cost Deposits At Last

Mahan believes Live Oak Bank’s long quest to attract low-cost deposits without a branch network is about to be solved. In the third quarter of 2022, the bank will launch an integrated banking strategy that combines its deep vertical experience with this cutting-edge technology.

“All the work we’ve done to create a cloud-based, API-first bank will allow us not only to create unique products and solutions but to deliver them to unique locations,” Huntley Garriott, the bank’s president, told analysts. will also allow.” He noted that big fintech companies like Plaid and Stripe have made it much easier for companies to incorporate financial services solutions. They do this with simple developer portals that use well-structured APIs.

Live Oak will launch such a developer portal for use by the thousands of software companies the bank already lends to meet the needs of the vertical. The first of these will be its original vertical, veterinarians. As Mahan explains, practice management software is how veterinarians run their businesses: they manage appointments and order the drugs and other supplies they need. With the bank’s new portal, it would be a 30-minute exercise for a practice management software company to integrate Live Oak Bank’s lending and collection capabilities into its software, Mahan says.

“Integrated banking technology will give us two key elements,” Garriott says. “The first is a single distribution channel. You can think of each of these software companies as a branch that will allow us to get lower-cost customers from these small businesses. The second is greater adherence to these clients as their financial services are integrated into their day-to-day business.

The management of Live Oak Bank is counting on doctors not only to get loans from the bank. But to keep interest-free deposits there. As the veterinary vertical take off, Mahan says he’ll give his sales team free rein. To call every practice management software vendor in the 35 verticals.

For more information, please visit Friday night funkin unblocked games 911.